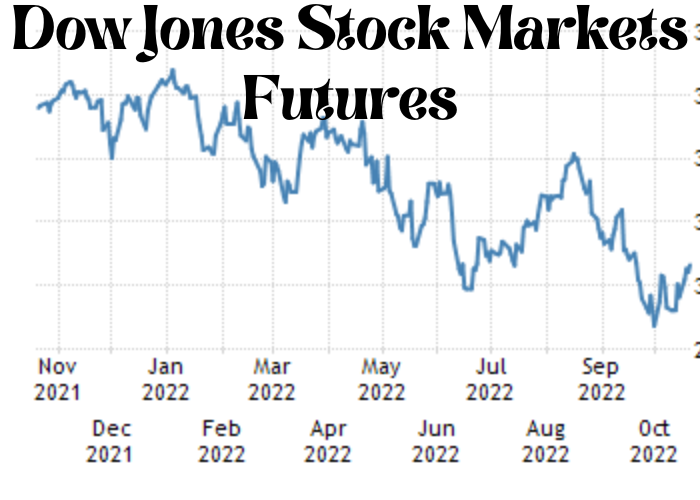

When it comes to the Dow Jones Stock Markets, there are futures, and there are stocks. The futures markets involve predicting what the stock prices will be at a specific future date. This is usually done by investors who believe that they have an idea of what will happen with a particular stock or company in the near future. In contrast, stocks are actual pieces of paper (or digital certificates) that represent ownership in a company. When you buy a share of stock, you’re buying a tiny piece of that company and become entitled to vote on important decisions like who should be on the board of directors or whether to merge with another company. Most people think of stocks when they think about investing in the market, but futures can be just as profitable if you know what you’re doing. In this post, we’ll go over the basics of Dow Jones Futures so that you can decide if this type of investment is right for you.

The Dow Jones Industrial Average (Djia) Is a Stock Market Index That Tracks the Performance of 30 Large, Publicly-Traded Companies in the United States

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large, publicly-traded companies in the United States. The Dow Jones Industrial Average is the oldest and most widely-followed stock market index in the world, and it is often used as a barometer for the overall health of the U.S. economy. The Dow Jones Industrial Average is calculated by taking the sum of the stock prices of the 30 companies that make up the index and then dividing it by a divisor which is continuously adjusted to account for changes in the number of shares outstanding. The Dow Jones Industrial Average is named after Charles Dow, one of the founders of Dow Jones & Company, and it was first published on May 26, 1896. Since its inception, the Dow Jones Industrial Average has been one of the most closely watched economic indicators in the world.

The Djia Is One of the Oldest and Most Widely-Followed Stock Market Indices in the World

The Dow Jones Industrial Average (DJIA) is one of the oldest and most widely-followed stock market indices in the world. The index, which was created in 1896, is comprised of 30 blue chip stocks that are seen as a bellwether for the overall U.S. stock market. The DJIA is often used as a barometer for the health of the U.S. economy, and it is closely watched by both investors and policymakers. Historically, the index has been relatively stable, but it has experienced sharp swings in recent years. The DJIA reached an all-time high in October 2007, but it subsequently plunged during the financial crisis of 2008. The index has recovered since then, but it remains well below its pre-crisis peak. Given its importance, the DJIA will continue to be closely watched by market participants in the years ahead.

The Djia Is a Price-Weighted Index, Meaning That Each Component Stock’s Price Contributes to the Index’s Overall Value

The DJIA, or the Dow Jones Industrial Average, is a stock market index that measures the performance of 30 large, publicly-traded companies in the United States. The DJIA is a price-weighted index, meaning that each component stock’s price contributes to the index’s overall value. The index is calculated by adding up the prices of all 30 stocks and dividing by a divisor, which is constantly adjusted to account for changes in the number of shares outstanding. The DJIA is one of the oldest and most widely-followed stock market indices in the world, and it is often used as a barometer for the overall health of the U.S. stock market.

The Djia Is One of the Most Commonly Used Benchmarks for Measuring the Performance of the U.S. Stock Market

The Dow Jones Industrial Average, or DJIA, is one of the most commonly used benchmarks for measuring the performance of the U.S. stock market. The DJIA is a price-weighted index, meaning that each component stock is weighted according to its price. The index is composed of 30 large, publicly traded companies that are representative of different sectors of the U.S. economy. The DJIA was first calculated in 1896 and is named after Charles Dow, one of the co-founders of The Wall Street Journal. The index is widely followed by investors and provides a good overview of how the U.S. stock market is performing. While it is not the only measure of stock market performance, it is certainly one of the most important.

The Dow Jones Industrial Average Is Named After Charles Dow, Who Co-founded Dow Jones & Company in 1882

The Dow Jones Industrial Average (DJIA) is one of the world’s most widely-followed stock market indices. The index is named after Charles Dow, who co-founded Dow Jones & Company in 1882. The DJIA is made up of 30 large, publicly-traded U.S. companies, and it is often used as a barometer for the overall health of the U.S. stock market. The DJIA is calculated by taking the stock prices of the 30 component companies and averaging them together. The average is then weighted so that companies with higher stock prices have a more significant impact on the index. The DJIA is updated every 15 seconds during U.S. trading hours, and it is one of the most watched financial indicators in the world.

The Djia Was First Published on May 26, 1896, and It Has Been Calculated Continuously Since October 1, 1928

The Dow Jones Industrial Average (DJIA) is a stock market index that represents the average value of 30 large, publicly traded companies in the United States. The DJIA was first published on May 26, 1896, and it has been calculated continuously since October 1, 1928. The index is named after Charles Dow, one of the founders of The Wall Street Journal, and it is often used as a broad measure of the performance of the U.S. stock market. The DJIA is price-weighted, meaning that companies with higher stock prices have a more significant impact on the index. As of May 2019, the DJIA is hovering around the 27,000 mark. While this number may seem high, it is actually down from its all-time high of over 36,000 in October 2007. The current level is still significantly higher than its low point during the financial crisis in March 2009, when it fell to around 6,500.

Conclusion:

Despite the fact the Dow Jones Industrial Average was down more than 600 points at one point during Friday’s session, the stock market managed to stage a massive turnaround and close higher for the day. The intraday volatility caused by concerns over rising interest rates and trade tensions sent shockwaves through the markets, but ultimately stocks recovered and ended the day in positive territory. If you are concerned about the current state of affairs in the stock market, be sure to stay up-to-date on all of the latest news and developments. And if you want help making sense of it all, our team of experts is here to help. Give us a call today to learn more about how we can help you protect your investments in these turbulent times.